Phone : (315) 436-3326

Email : info@djbuss.net

Hopewell Junction, NY 12533

Mon Fri : 7am to 7pm

Sat : 7am to 12pm

Financial Statement Analysis

When analyzing financial statements, a lot of attention is paid to the income statement which is appropriate however the income statement tells only half of the story of what has happened during this time period. The balance sheet presents assets and liabilities at a point in time. However, the Cash Flow statement is where al of the decisions are represented over the time period. It combines the changes in the assets and liabilities and the equity in one report. This why I believe the Cash Flow statement is the most important of all. The statement below represents the

FASB95 format:

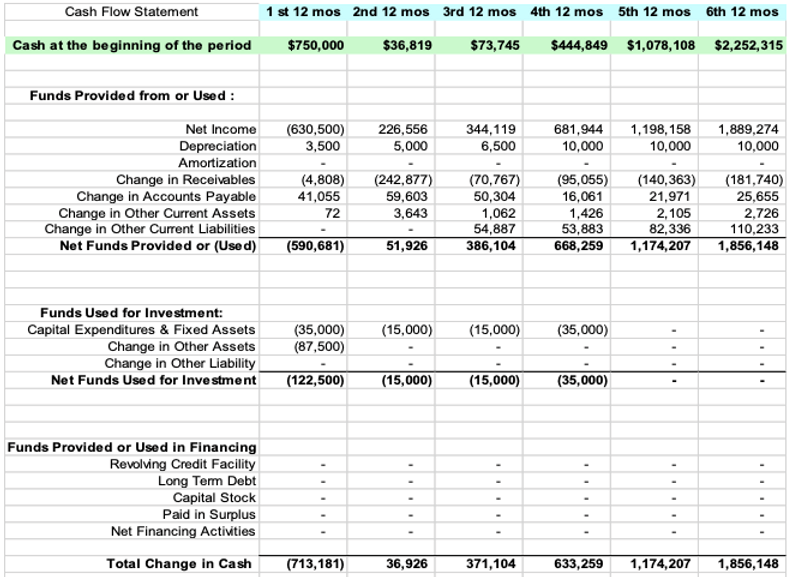

Notice it starts with Cash at the beginning of the period and identifies the funds provided or used from operations: Net income or loss from the income statement, Depreciation is added back because it is non-cash item, then the changes in Working Capital [Current assets and Current liabilities], these items added together is called Net Funds Provided or Used by the company.

Usually, a start-up company will Use Funds for the first few years until they build critical mass by building sale and minimizing relative expenses.

The next section is Funds Used for Investment or [Capital Expenditures]. The last section is funds provided by or used in financing operations. Examples of funds used in this section would be paying down debt. Most of all the other items represent cash that has come into the company either by issuing, stock, new debt, or additional paid in capital.

Therefore, you can see from this simple example that all of the decisions made by management are reflected here, which is why it is the most important statement of all the financial statements. The balance sheet is as of a moment in time, the income statement is only half the story. An investment banker said to me when you are out of cash, you are out of business!

Cash Is Still King

The definition of cash flow sometimes depends on the application; examples are Wallstreet calls EBITDA operational cash flow, others will define as net income plus; here is all non-cash items, here is good example:

When attempting to determine which project to invest in when you have multiple competing projects a good method is to calculate the internal rate of return, or commonly know as DCFROI. Discounted cash flow return on Investment. If you would like to know how to calculate this just call me.